Every payday you’ve nice intentions. You swear that that is the month the place you aren’t going to spend an excessive amount of cash. You’ll watch each penny and hold your spending below management. Earlier than you understand it, you possibly can’t even afford to purchase groceries. Is there a solution to your downside? Sure. STOP SPENDING MONEY.

Overspending is an issue which impacts many individuals. Whether or not you’re wealthy or wrestle to make ends meet, you too would possibly discover that you simply spend an excessive amount of. Some causes are monetary, and others are emotional.

The primary manner you may get spending below management is to have a look as to why you’re spending an excessive amount of. That is step one. Nobody can reply this query however you.

After years of serving to hundreds of readers (identical to you), I’ve compiled an inventory of the highest 12 causes that individuals overspend. You would possibly end up in a single, two or much more!

HOW DO YOU KNOW IF YOU ARE OVERSPENDING?

YOU’VE MAXED OUT YOUR CREDIT CARDS

When there isn’t any room to cost something in your playing cards, you might need an issue. Typically, maxed bank cards indicators you’re residing past your means. If you must proceed to cost since you don’t have cash, then you’re spending an excessive amount of.

YOU CAN’T FIND A HOME FOR YOUR LATEST PURCHASE

Your temptation may be electronics or purses. It doesn’t matter what you’re keen on to purchase, you would possibly discover you’re working out of room to retailer issues. When the stuff takes over your house and is inflicting muddle, it’s time to take an extended laborious take a look at the way you spend cash.

YOUR BUDGET NEVER WORKS

There could also be months once you don’t find the money for in your finances to cowl your mortgage or meals. Once you frequently spend cash on the unsuitable issues, your finances is not going to work.

Which means when you have simply $50 for leisure, don’t spend $75. That different $25 has to return from one other finances line.

YOU SPEND MORE THAN YOU EARN

Check out your bank card balances. You may be paying solely the minimal steadiness as a result of you possibly can’t pay it in full. Once you spend greater than you make and proceed so as to add extra debt, check out what you’re shopping for. It may be time to drag again and keep out of the shops.

HOW TO STOP SPENDING SO MUCH MONEY

Now you can see the way you spend your cash, the following step is to make a change. You must cease throwing it away. Proper now. Listed below are the steps to take to manage and cease spending cash.

1. MAKE A BUDGET

I do know, I do know. I in all probability sound like a damaged report as I hold citing this finances factor. Nevertheless, it’s true. When you do not need a finances, you haven’t any thought the place you’re spending your cash.

A finances is required so as to direct your cash the place to go every time you receives a commission. It additionally helps you know the way a lot you must obtainable to spend on groceries, clothes, eating out and even leisure. When you understand you’ve a restricted quantity to spend on particular classes, you’re immediately answerable for our spending.

Learn extra: The way to Create a Funds (even should you suck at budgeting)

2. PLAN AHEAD

Meal planning is one factor many individuals don’t take into consideration in terms of overspending. When you don’t plan your meals (and inventory your fridge and pantry accordingly), you usually tend to run out to eat for dinner. Doing this at $25 a pop 2 or 3 instances per week takes its toll in your finances.

Making a meal plan is not going to solely show you how to management your spending, however you may additionally discover that you simply eat (and really feel) a lot better too.

3. USE A SHOPPING LIST

Earlier than you go to the shop, it’s important you make an inventory. Examine your fridge, freezer, and pantry so that you’re not buying gadgets you don’t want – particularly produce.

There may be a lot waste of meals that expires earlier than you possibly can devour it. That leads to you shopping for gadgets in order that they’ll find yourself proper within the trash can. Be sure you plan your purchasing journey after which buy simply what you want, in addition to what you possibly can eat earlier than you hit the shop the next week.

4. STOP PAYING FOR CONVENIENCE

There’s a fast repair for almost the whole lot. You’ll find dinners in packing containers, small pre-packaged snacks, and so forth. Moderately than buy comfort gadgets, purchase the bigger dimension snacks after which re-package your self into smaller baggies. You’ll not solely get extra out of a field, however you possibly can even management how a lot you place into every baggie.

There are different methods we pay for comfort. We pay for somebody to iron our shirts, wash our vehicles and even mow our lawns. By doing this stuff ourselves, we will hold rather more cash and simply cease overspending.

Learn extra: How You might be Killing Your Grocery Funds

5. STOP USING CREDIT CARDS

We stay in an age the place our cash is all digitally tracked, be it on credit score or debit playing cards. Sure, they’re extra handy, however they make it straightforward to overspend. Once you use money, it’s unimaginable to overspend. You actually can. Not. Do. It.

I hear on a regular basis that individuals repay playing cards on the finish of the month and that they don’t overspend, however that isn’t the reality for most individuals. You would possibly suppose that it’s simply $10 per week. Nevertheless, that $10 per week is a success of $520 over the course of a 12 months. What might you do with a further $500 in your pocket?

Learn extra: The way to Create a Workable Money Funds System

6. PAY YOUR BILLS ON TIME

All of us have payments. We all know when they’re due. Once you miss the cost due date, you get assessed a late cost. Pay them on time, so that you don’t pay greater than that you must.

Along with late charges, not paying your payments on time can have an hostile impact in your credit score rating.

Study learn how to manage your payments, so that you by no means pay them late once more.

7. DO NOT LIVE ABOVE YOUR MEANS

Few of us wouldn’t love new garments or a brand new automotive. All of us would love to make more cash or get the most popular new system. The factor is, are you able to afford it? Is it a need or is it a necessity?

In case you are utilizing credit score or loans to get gadgets you can not afford, then you’re residing past your means and spending cash you don’t have. Reduce and just remember to can actually afford the home or the automotive and that it doesn’t damage your finances and price you an excessive amount of.

Learn extra: Defining Your Needs vs. Your Wants

8. DON’T FALL FOR IMPULSE BUYS

Shops are sneaky about making us spend cash. They use indicators, format, and even scents to lure you into wanting to purchase extra. The factor is, if you are going to buy one thing you didn’t intend to, then you’re already blowing your finances and doubtless overspending.

One other manner that you’re spending an excessive amount of is once you plan dinner however then resolve on the final minute to exit to dinner as a substitute. Why try this when you’ve meals ready for you at dwelling (which you’ve already paid for)?

The ultimate cause it’s possible you’ll impulse purchase is that of emotion. When you really feel a rush due to that new merchandise, it’s possible you’ll buy out of impulse and emotion as a substitute of want.

Learn extra: Stopping Impulse Purchasing

9. FIND ANOTHER BOREDOM FILLER

I bear in mind being in a web-based discussion board when my youngsters had been little, and we talked about our day. Lots of the moms went to the shop each. Single. Day. They stated they may not deal with being in the home and simply needed to go someplace. That resulted in them shopping for issues they didn’t want.

In case you are bored, discover a new interest. When you simply must get out of the home, why not go for a stroll or play a sport with the youngsters? Discover a technique to redirect your boredom so that you keep out of the shop and cease overspending.

10. USE FINANCIAL GOALS

Once you do not need monetary targets, you don’t have anything to work in the direction of. You would possibly wish to get out of debt, or you might have considered trying that newer automobile.

Check out what you’re spending every week on non-essential gadgets. What would occur should you would put that cash into financial savings or paid off your debt as a substitute? How a lot nearer would you be in the direction of getting that new automotive or being debt free?

Discover a aim you wish to obtain. Discuss to your loved ones and see when you have one thing you possibly can work in the direction of collectively. By setting a aim that everybody desires, you’ll all be extra conscious of your spending and can contribute in the direction of reaching it extra shortly.

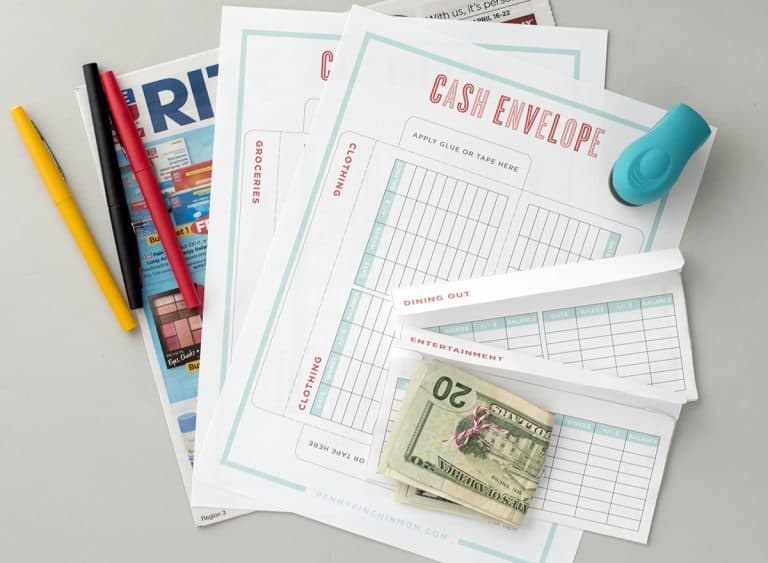

11. STOP SPENDING MONEY WHEN YOU TRACK YOUR SHOPPING

I do know many individuals who’ve tried to make use of money, they usually say it doesn’t work as a result of they spend it too shortly. There are others I do know who spend an excessive amount of on plastic every month. The reason being that they don’t seem to be monitoring what they spend, which is a cause why they overspend.

When you use money, that is the place the envelope system is most useful. You’ll monitor your spending out of every one so you possibly can see the place your cash goes. Because the envelope quantity will get smaller and smaller, you suppose twice earlier than you choose up that merchandise — as a result of it’s possible you’ll not be capable to afford it.

You are able to do this identical factor should you use plastic. There are all types of monitoring apps that will help you monitor what you’re spending on your whole varied classes.

Regardless of the way you pay for gadgets, be sure you are all the time monitoring what you spend – you may be shocked to be taught the place your cash goes.

Learn extra: Creating and Understanding a Spending Plan

12. DON’T FALL FOR THE SALES

Once you stroll into the shop, pay no thoughts to the gross sales. Use your record and follow it. Don’t fall for the flowery gross sales indicators, smells, and flashing lights to lure you into shopping for one thing you don’t want.

Learn extra: Understanding the Tips Shops Use to Get You to Spend Cash

Earlier than you possibly can acquire management of your funds, that you must work out why you’re spending greater than it’s best to. Easy adjustments to the way in which you view cash could make all of the distinction.