It’s vital to have monetary targets. However it may be tough to see how your cash administration habits are affecting your targets with out taking a look at a giant assortment of accounts the place your cash is saved.

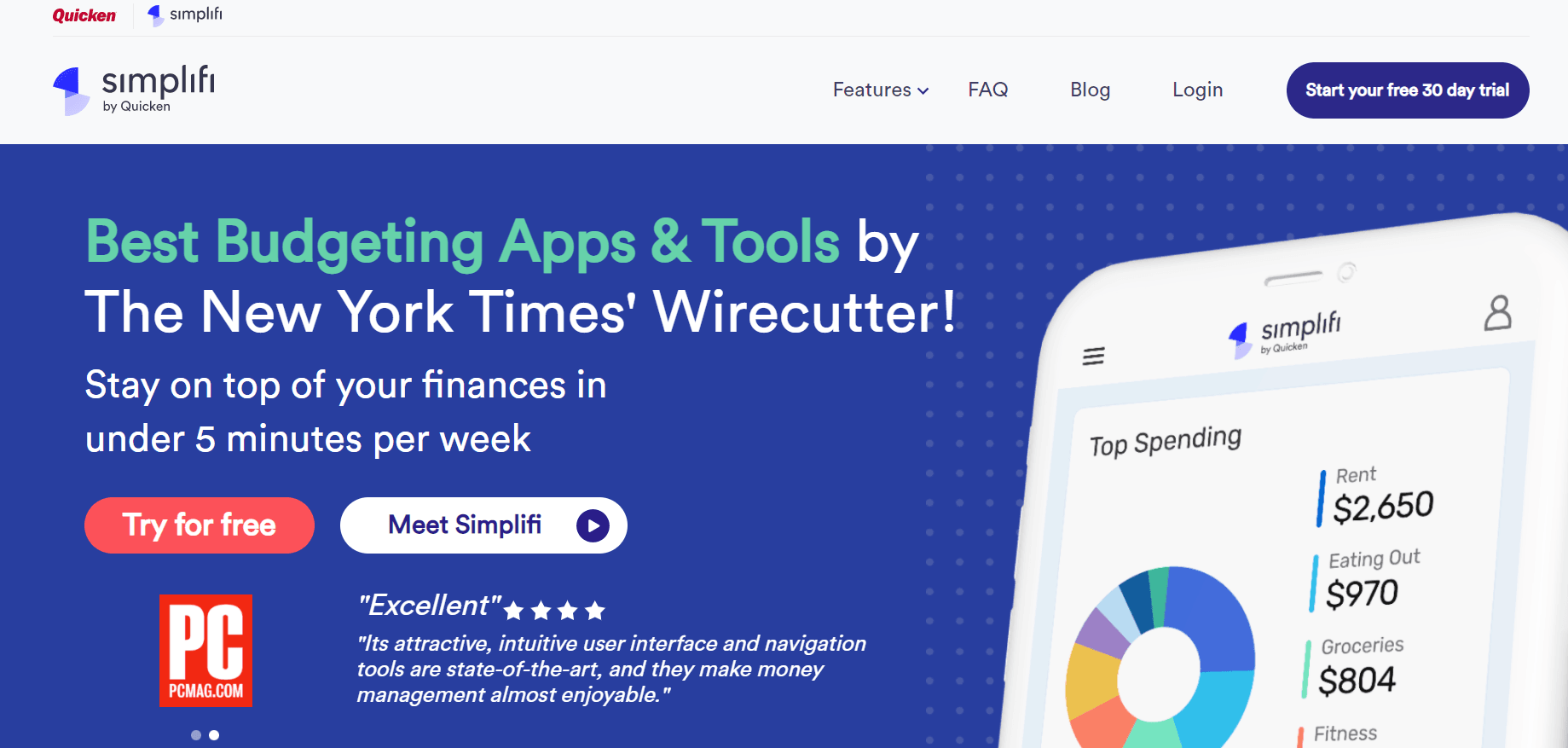

Simplifi by Quicken affords a brand new method to sustain with your whole cash in a single easy-to-use interface. You received’t should spend time bopping from account to account simply to see the place your funds stand. As an alternative, you may log into Simplifi to see the large image at a second’s discover. Plus, the app may also help you handle smaller cash duties that affect your day-to-day spending.

Let’s take a better have a look at what Simplifi has to supply. Then you may resolve for your self whether or not or not this cash administration app is an efficient match for you.

What’s Simplifi?

Simplifi is a cash administration app provided by Quicken. The purpose of the app is to supply an entire image that can assist you handle your funds successfully.

Quicken launched the brand new app in 2020. Quicken has been within the monetary administration software program house for over 30 years and has a strong fame in addition. With that, it’s best to really feel assured within the data that Simplifi affords a reliable expertise.

How does Simplifi work?

Wish to work with Simplifi? Right here’s what you’ll have to do.

First, head to the Simplifi residence web page and choose “Begin your free 30-day trial.”

At this level, you’ll want to decide on which plan you wish to work with. The alternatives are the annual plan, which comes with a month-to-month value of $3.99 per 30 days, or the month-to-month plan, which prices $5.99 per 30 days.

In both case, you’ll be capable of attempt Simplifi without spending a dime for 30 days to get began.

As soon as you choose the plan you need, you have to to supply an e mail deal with and a type of cost. You may select to pay by way of bank card, debit card, or PayPal. Importantly, you’ll have the flexibility to cancel your subscription at any time.

After you’ve created your account, you’ll be capable of hyperlink your accounts from over 14,000 monetary establishments. With these linked accounts, Simplifi will begin delivering clear insights that can assist you handle and enhance your monetary image.

How a lot does Simplifi value?

Simplifi is a paid app. You may select from two cost tiers.

You may pay $47.99 for your entire 12 months, which works out to $3.99 per 30 days. Or you may pay $5.99 on a month-to-month foundation.

However you can provide Simplifi a attempt without spending a dime. The trial lasts for 30 days and provides you entry to the entire options that Simplifi has to supply. That makes the trial an important choice to see if you happen to like utilizing the Simplifi app to handle your private funds.

Whichever possibility you select, you should have the flexibility to cancel your subscription at any time.

Simplifi options

Now that you realize a bit about Simplifi’s background, let’s take a better have a look at the options that you simply’ll discover helpful with this private finance app.

A chook’s eye view of your funds

Though it is very important sustain together with your private finance habits, the duty isn’t all the time straightforward. In truth, it may be downright tough to know the place you stand with a number of accounts to maintain monitor of.

Simplifi adjustments the sport of cash administration, and as its title suggests, the app supplies a streamlined method to handle your cash in a easy means. Since you may join accounts from over 14,000 monetary establishments, you’ll possible be capable of see a transparent image of your total monetary life in a single snapshot.

Spending monitoring

The app will routinely categorize your spending so that you could rapidly see the place your cash goes. Should you don’t just like the breakdown, you should utilize the knowledge supplied by Simplifi to make adjustments to your spending patterns.

Spending plan

Not like some apps that simply monitor your spending, Simplfi takes issues to the following stage.

Not solely will Simplifi monitor your spending in a breakdown of classes, but additionally enable you to chart your future spending plans. Basically, the app is prepared that can assist you construct a price range that takes your precise revenue and payments under consideration.

Moreover, Simplifi will draw your consideration to any upcoming payments. The app will enable you to match the costs to suit them into your projected price range. Whenever you see these future fees, you’ll have the possibility to cancel forward of time if the subscription not suits in your price range or serves your way of life.

Watchlists to maintain you on monitor

A spending plan with out built-in monitoring received’t enable you to obtain your targets. That’s when the watchlists created by Simplifi turn out to be useful.

As a person, you may arrange watchlists to mirror your best spending targets particularly budgeting classes. When you arrange your best spending goal, Simplifi will monitor your spending and allow you to know in case you are getting near the restrict.

‘Shut’ relies in your definition – not Simplifi’s. With that, you may have Simplifi let you realize while you’ve spent 50 to 90% of your restrict for any specific watchlist. That’s an important characteristic since you don’t wish to obtain reminders that don’t matter to you. In spite of everything, nobody wants extra notifications!

You may select to set these watchlists to reset on a month-to-month foundation or roll on all year long. The beauty of these watchlists is that they may also help you retain tabs in your spending with none guilt concerned. As an alternative, arrange the boundaries you are feeling comfy with and permit Simplifi to remind you when it’s nearly time to cease spending on this class.

Monetary studies with detailed graphics

Simplifi affords a variety of monetary studies constructed on the knowledge gleaned out of your accounts. You may see an in depth breakdown of a number of metrics, together with Spending, Earnings, Web revenue, Financial savings, Month-to-month summaries, Refund monitoring, and Web value.

Every of those studies will turn out to be useful in some unspecified time in the future or one other. Personally, I actually just like the month-to-month summaries possibility. These may also help you see the place you stand every month to point out you find out how to keep on monitor in direction of your long-term targets.

Financial savings targets

No private finance app could be full with out the flexibility to set and monitor financial savings targets. Fortunately, Simplifi delivers on this space.

You may rapidly arrange financial savings targets for issues that you simply care about. After all, you’ll be capable of monitor and see your progress. However you’ll additionally obtain insights from Simplifi that may enable you to maximize your financial savings.

Earnings tracker

Final however not least, Simplifi affords an revenue tracker. As money flows into your accounts, Simplifi will preserve monitor of every thing. With that data, the app will enable you to preserve sufficient money into your checking account to cowl upcoming payments.

The revenue tracker is a superb characteristic for anybody. However it’s particularly helpful for anybody that has an irregular revenue. With Simplifi, you may keep up to the mark to make sure that you’ve gotten the cash you must pay your payments.

My expertise researching Simplifi

At its most elementary stage, Simplifi is a private finance app that can enable you to preserve monitor of your whole monetary particulars. Though you could possibly handle your cash with out Simplifi, the app makes life considerably simpler.

Personally, I like the revenue monitoring characteristic. As a freelancer with a considerably irregular revenue, I feel the truth that Simpilifi can preserve monitor of every thing coming in may be very helpful. Moreover, I like that you could simply see the place you stand within the massive image with the clear internet value characteristic.

Lastly, I feel that the spending studies are extremely helpful for anybody that wishes to dig into the small print of their private funds. As a private finance nerd, I like this characteristic. However I can see the way it is likely to be a bit overwhelming for somebody that’s simply on the lookout for an app to assist them keep on price range.

Who’s Simplifi greatest for?

So, is Simplifi best for you? It is likely to be if you happen to fall into one of many classes beneath.

Those who need a complete image of their cash

There isn’t a denying that Simplifi supplies a transparent overarching image of your funds. When you hyperlink your accounts, you’ll be capable of log in at any time to see precisely the place your funds stand.

You may have a look at the large image together with your internet value snapshot. Or you may look into the vital particulars like whether or not or not you’ll be able to pay your payments this month. Simplifi will enable you to keep on monitor to achieve your cash targets.

These prepared to pay for an ad-free expertise

Though you could find a free budgeting app, it is likely to be value it to pay for an ad-free expertise. In spite of everything, you don’t wish to be distracted by adverts if you find yourself on a mission to sort out your private funds.

Simplifi is pretty inexpensive. With that, it would make sense to pay for its worthwhile options.

These on the lookout for useful steering alongside the way in which

As you’re employed with Simplifi, you’ll discover useful insights alongside the way in which. The app is designed that can assist you attain your private finance targets. All through the expertise, you’ll encounter useful ideas that may enable you to transfer the needle in direction of your monetary targets.

Who shouldn’t use Simplifi?

After all, Simplifi isn’t for everybody. Right here’s when it won’t be a very good match.

You don’t wish to pay for a budgeting app

I fully perceive! You wish to get your private funds so as, and the very last thing you might be prepared to pay for is a private finance app. If that’s the case, then Simplifi isn’t the appropriate alternative for you.

You wish to take a deep dive into your investments

Simplifi will preserve tabs on the fundamentals of your investments. However if you wish to dive deeper into the small print of your investments, Simplifi shouldn’t be designed with that in thoughts.

You could wish to take into account Quicken’s premier product if you wish to put your investments underneath a microscope.