If you consider budgeting, you could think about allocating money in individually labeled envelopes or crafting sophisticated spreadsheets with numerous colours and fonts.

Budgeting can imply these issues — however do you know that bank cards might be one of the vital potent budgeting instruments? It sounds counterintuitive since unsecured credit score strains can too simply tempt many cardholders to overspend somewhat than save. However when you have the self-discipline, they’re a superb budgeting useful resource.

Should you suspect you might be an emotional spender, it’ll undoubtedly behoove you to keep away from bank cards till you’ve conquered that facet of your fiscal habits. “Good” forms of debt exist (like mortgages and auto loans), however bank card debt isn’t one in all them.

However if you happen to’ve acquired the monetary maturity, observe these rules to finances with bank cards efficiently.

Learn extra: How one can use a bank card responsibly

Use your playing cards like money

Whether or not you’re intentionally budgeting with a bank card or not, the important thing to bank card success is to deal with them like money. If you buy one thing, pay it off (nearly) instantly.

You don’t have to attend till you obtain your month-to-month bank card invoice to make funds. Many people, together with me, make a number of funds throughout a billing cycle somewhat than one month-to-month lump fee. It’s pointless (until you’re making massive purchases), but it surely’s a psychological maneuver I take advantage of to assist me consider my strains of credit score as money — not simply free cash.

I watch my month-to-month web revenue dwindle with every bank card fee, and it retains me on monitor. Plus, you’ll by no means have to fret about being dinged with a late payment.

Use built-in budgeting software program

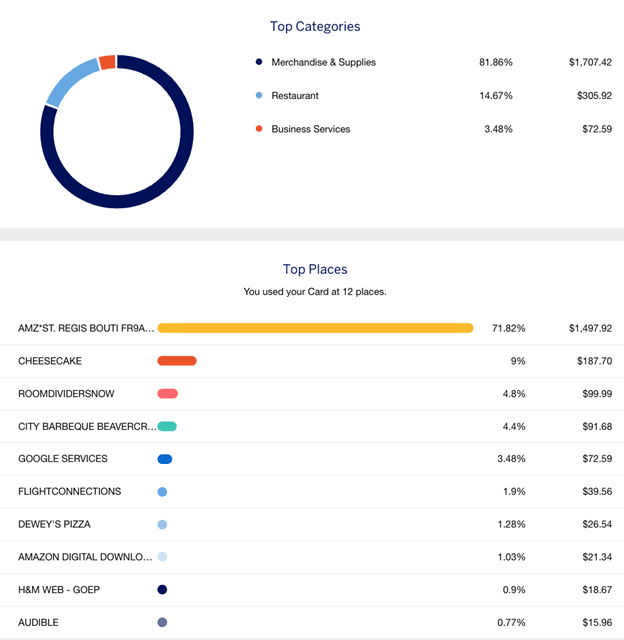

Many bank card issuers (like Chase and Amex) neatly monitor your spending and make it simple so that you can view at a look how a lot you’ve spent in every class every month. It’ll present you what you’ve expended for journey, eating, merchandise, enterprise providers, and many others.

That is enormous for diligent budget-keepers. You must reference this very digestible (and fairly) software towards the boundaries you’ve set your self. Should you’re a number of days into the month and also you’ve already spent an inordinate quantity on leisure, you possibly can spot the development instantly.

Word that this knowledge’s default will possible show your spending since your final billing cycle. Should you’re focused on month-to-month, or maybe paycheck-to-paycheck, you’ll need to manually change the date ranges you’d wish to view.

Supply: American Categorical

Issuers additionally typically will let you set alerts in your bank card spending habits. For instance, Amex provides you the choice to obtain an alert if you spend a specific amount throughout a billing cycle or make a purchase order above a specified quantity. You may also obtain a weekly snapshot of your account spending.

Use completely different playing cards for various purchases

I presently have eight bank cards. Six are private playing cards, and two are small enterprise bank cards. I wish to maintain my private and enterprise spending separate — and utilizing small enterprise playing cards helps tremendously when budgeting for month-to-month bills.

Learn extra: 12 causes bank cards are must-haves for monetary wellbeing

Whether or not you’re in an identical state of affairs or just discover it useful to put sure bills on completely different playing cards, this may be one other option to implement your finances and categorize your money circulation. For instance, you will have a bank card devoted to:

- Grocery shops.

- Month-to-month utilities.

- Fuel stations.

- Every little thing else.

If you log into your fuel station card’s on-line account, you’ll shortly see how a lot you’ve spent on fuel for the month. No different purchases have posted to that account — and if they’ve, they’re both fraudulent, otherwise you’ve been impulse-spending.

This could be a option to clear the noise from a single card with an inventory of transactions a mile lengthy. Should you’re over finances this month, you’ll discover the issue in your “all the things else” card.

Learn extra: Utilizing a number of financial institution accounts to regulate your spending

Add (and use) approved consumer playing cards

Many playing cards provide the good thing about free approved customers — or within the case of small enterprise playing cards, free worker bank cards. The magic budgeting trick right here is that some banks (like American Categorical) will let you set spending limits distinctive to approved consumer/worker playing cards.

You could possibly merely add buddies or relations to your card and maintain them your self. Add as many approved customers as you’ve gotten spending classes, and set every restrict accordingly. American Categorical lets you decrease every spending restrict to $200.

Purchase reward playing cards

One of many advantages of budgeting with money is that you’re compelled to remain inside your means — otherwise you’ll merely run out of cash. The hazard of bank cards is you could impulse-shop your manner into 5 paychecks from now if you happen to’re not vigilant.

Whereas not a flawless plan of assault, you possibly can nonetheless emulate a cash-based finances with a bank card. I’ve achieved this myself earlier than, and it actually might be useful.

A lot of retailers promote Visa reward playing cards which can be utilized anyplace Visa is accepted. At grocery shops, you possibly can typically purchase them in variable increments as much as $500. Should you’ve established a finances of $200 per thirty days for eating out, you should purchase a $200 reward card and mark it as “eating places.” In case your month-to-month finances for leisure is $150, you should purchase a $150 reward card and mark it “leisure.”

In any class for which you need to make sure you don’t overspend, you should purchase a Visa reward card for that precise quantity. When the reward card runs out, you’re achieved till subsequent month.

If this technique appeals to you, take into account the bonus classes of whichever bank card you intend to make use of; you could possibly earn bonus rewards in your reward card by tactfully buying your reward card from sure shops. For instance:

- In case you have the Amex Gold Card, you should purchase your reward playing cards from a grocery store. This card earns 4 Amex Membership Rewards per greenback on as much as $25,000 in purchases at U.S. supermarkets per calendar yr (then 1 level per greenback).

- In case you have the Ink Enterprise Money® Credit score Card, you should purchase your reward playing cards from Staples. This card earns 5% again on the primary $25,000 you make in mixed purchases every account anniversary yr at workplace provide shops and on web, cable, and cellphone providers.

The principle downfall of this technique is that reward playing cards often include an activation payment of $5 or extra. Should you’re not prepared to eat $5 (it might add up shortly if you happen to’re shopping for a number of reward playing cards), look forward to the intermittent retailer promotions that waive this payment.

Fast word: you (in all probability) can’t use your bank cards for all the things

A handful of bills merely can’t be made with a bank card. For instance, most lenders won’t allow an auto mortgage or mortgage to be paid with a bank card. Nevertheless, if it helps your budgeting to run all funds via your bank card, there are loopholes:

- Plastiq is a service that costs a payment (2.85% on the time of writing) to pay absolutely anything with a bank card — together with mortgages and automotive funds. Use your bank card to pay Plastiq, they usually’ll lower a verify to almost any biller or service provider for you. There are some card issuer-specific restrictions, so examine if this pursuits you.

- The no annual payment Bilt Mastercard® is the one bank card available on the market that lets you pay hire for zero charges. You’ll even earn one Reward per greenback on as much as $50,000 in hire every year. Word that you will need to make a minimum of 5 purchases per billing cycle to earn rewards.

With these providers, you possibly can pay your largest month-to-month payments whereas nonetheless utilizing your bank cards as budgeting instruments.

Learn extra: Money vs credit score vs debit — which must you use?

Backside line

Strictly utilizing money is the old-school — and foolproof — option to finances. Should you don’t use credit score, you received’t end up in debt, and also you received’t be topic to nightmarish curiosity costs.

However the issue with this technique is that you simply received’t bolster your credit score historical past or earn worthwhile bank card rewards by budgeting this fashion. If you realize a number of tips, budgeting with bank cards might be extremely efficient, to not point out simple. Simply remember to finances for bank card annual charges if you happen to plan to make use of playing cards that incur them.

Featured picture: Geobor/Shutterstock.com

Learn extra: