Should you’re a sufferer of one of many latest devastating hurricanes, you in all probability have already got a lot in your thoughts. The very last thing you want is a protracted intro reminding you of how horrible hurricanes are.

So let’s get proper right down to it.

Right here’s a breakdown of the tax reduction provided by the IRS to victims of Hurricane Fiona and Hurricane Ian.

To preface, a very good tax software program or tax professional might help you with all this. Half of all Individuals use a stay tax skilled to assist them file their returns, and the remainder use e-filing tax software program that’s turning into simpler to make use of with each passing 12 months.

So don’t really feel like it’s essential memorize all of those {qualifications} and varieties. Simply know they’re there, and bookmark this web page for tax season.

TL;DR: The IRS is Providing 4 Types of Tax Aid

I’ll break down the who/what/when beneath, however to get issues began, right here’s a fast abstract of the reduction the IRS is providing catastrophe victims in 2022:

- Deadline extensions — Just about any filings you owed the IRS between now and January have been pushed again to February 15, 2023.

- Certified catastrophe losses — Casualty losses (i.e., property harm) incurred can now be listed as a certified catastrophe loss with extra tax reduction.

- Charges waived for previous tax returns — Victims in affected areas can request copies or transcripts of previous tax returns with out paying the $43 payment.

- Collections or examinations could also be reassessed — Catastrophe victims who’ve been contacted by the IRS on a group or examination matter might even see extensions or extra types of reduction.

Who Is Lined?

Hurricane Ian Victims (All of Florida)

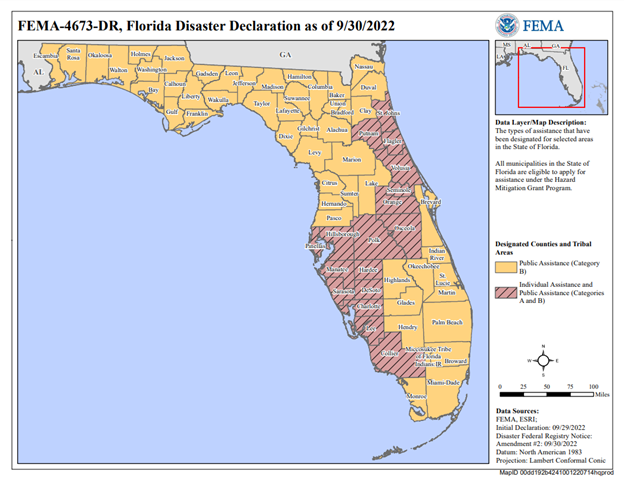

The IRS claimed it’s going to work with hurricane victims “all through Florida” who suffered losses as a result of hurricane.

They usually’re not exaggerating. It’s actually all of Florida.

That’s as a result of within the occasion of a catastrophe, the IRS goes by the Federal Emergency Administration Company (FEMA)’s official map of stricken areas. And Ian was so uniquely devastating that FEMA simply declared the entire state an affected space.

Supply: FEMA

In consequence, it consists of all people and households that reside or have a enterprise “anyplace within the state of Florida.”

Hurricane Fiona Victims (All of Puerto Rico)

The IRS will even present similar tax reduction to victims of Hurricane Fiona with houses or companies in Puerto Rico. On the time of this writing, that’s “all 78 municipalities.”

Victims of Different Pure Disasters in 2022 (Alaska Storms, Wildfires, and many others.)

Broadly talking, the IRS’s response to most disasters has been to increase your deadlines and remind you to incorporate uninsured, disaster-related losses in your returns. So if you happen to’re impacted by the extreme storms in Alaska or the California wildfires, most of what you learn right here will doubtless apply to you.

Even nonetheless, it helps to verify and skim the fantastic print, as issues can change over time. Should you had been impacted by a non-hurricane associated catastrophe, head to the IRS’s devoted web page for Tax Aid in Catastrophe Conditions to learn extra about assist in your particular scenario:

Supply: IRS.gov

What if I’m Outdoors the Impacted Areas However My Enterprise Was Nonetheless Affected?

Tax reduction is reserved for victims with addresses contained in the impacted areas. Meaning if your small business was impacted extra not directly by the hurricane, you in all probability don’t qualify for any type of tax reduction.

That mentioned, the IRS makes two exceptions, claiming they’ll work with:

- Any taxpayer who lives outdoors the catastrophe space however whose essential data to fulfill a deadline occurring in the course of the postponement interval are positioned within the affected space; and

- Staff aiding the reduction actions who’re affiliated with a acknowledged authorities or philanthropic group.

To interrupt down no. 1 a bit extra, the IRS is saying that if you happen to misplaced tax-sensitive paperwork within the hurricane (recordsdata, receipts, exhausting drives, and many others.) then you definately doubtless qualify for reduction.

Nonetheless, since you reside outdoors of the impacted areas, the IRS received’t routinely give you reduction. You have to contact them (866-562-5227) to clarify your scenario.

If I Qualify, What Do I Must Do to Declare the Aid?

To assert your deadline extensions, you simply must verify your tackle with the IRS utilizing your final tax return. In case your tackle on file with the IRS is inside FEMA’s official catastrophe areas, you routinely qualify for the deadline extensions. There’s no want to succeed in out to them.

That mentioned, you should still get an faulty penalty or late submitting discover. If that’s the case, the IRS says you simply must name the quantity listed on the penalty/discover to get it abated (i.e., eliminated).

To assert disaster-related casualty losses in your tax returns, you’ll want to incorporate a Catastrophe Designation on Kind 4684. To try this, you’ll write “Puerto Rico Hurricane Fiona” or “FL Hurricane Ian” in large daring letters up high. You’ll additionally want to incorporate the FEMA catastrophe declaration quantity: EM-3583-PR or DR-4673-FL, respectively.

Should you’re doing your individual taxes, Publication 547 might help you out with this.

Alright. Now that we all know who qualifies for reduction, let’s discuss what that reduction appears to be like like.

What Tax Aid is Out there to Victims?

Right here’s a way more detailed breakdown of the 4 factors listed in my TL;DR on the high of the article. And bear in mind, the IRS has loads of extra assets to additional help victims of Ian and Fiona:

Submitting Deadline Extensions

The IRS’s most important type of reduction is time. Briefly, if you happen to’re a resident of Florida or Puerto Rico and also you had a tax submitting deadline developing, it’s nearly definitely been pushed again to February 15, 2023.

That features:

- 2021 submitting extensions initially due on October 17, 2022

- This autumn 2022 estimated tax funds initially due on January 17, 2023

- Quarterly payroll and excise tax returns initially due on October 31, 2022 and January 31, 2023

It by no means hurts to start out early in your taxes — particularly if you want time to calculate your certified catastrophe loss, mentioned beneath — however a minimum of now you could have one much less factor to fret about as you concentrate on restoration.

Uninsured or Unreimbursed Catastrophe-Associated Losses Can Be Claimed on 2021 or 2022 Taxes

Along with deadline extensions, victims will have the ability to listing certified catastrophe losses on their taxes to obtain some financial reduction.

Briefly, certified catastrophe losses are issues like dwelling repairs, automotive repairs/alternative, and many others., that you just incur as a direct results of the catastrophe. The IRS will will let you deduct a few of your losses remaining after insurance coverage has already paid out. Within the case of Hurricanes Fiona and Ian, you even have the selection of together with them in your 2021 returns (if you happen to had a sound extension) or your 2022 returns.

The method for figuring out and calculating certified catastrophe losses is a bit tough. Once more, tax software program and life tax professionals might help you out and file them appropriately. To study extra and/or take a stab at it your self, take a look at IRS Subject 515.

Charges Are Quickly Waived for Requests of Beforehand Filed Tax Returns

The IRS will at all times ship you a duplicate of your outdated tax returns upon request if you happen to file Kind 4506, however they usually cost a $43 payment (that’s why you at all times need to maintain your individual data).

Fortunately, for hurricane victims that payment is at present waived.

Anybody Contacted on a Assortment or Examination Matter Might Additionally Obtain Aid

On the very backside of their announcement, the IRS says that anybody who’s contacted by them on a “assortment or examination matter” can have the possibility to clarify how the catastrophe has impacted them.

They don’t present specifics, however it’s potential that if you happen to stay outdoors of the affected areas and the catastrophe has straight led to you lacking a deadline or a cost, you’ll have an opportunity to clarify your self and see some reduction.

What Different Federal Assist is Out there to Hurricane Victims?

Again in September, President Biden accepted FEMA assist to each Puerto Rico and Florida to assist hurricane reduction efforts.

To use for help, go to www.DisasterAssistance.gov. And for twenty-four/7 counseling you possibly can name the Catastrophe Misery Helpline.

The U.S. Small Enterprise Affiliation (SBA) additionally affords federal catastrophe reduction within the type of bodily harm loans, mitigation help, and many others. To study extra, go to the SBA’s catastrophe help homepage.

Lastly, the Client Monetary Safety Bureau (CFPB) affords a useful touchdown web page that merely consolidates all the federal monetary assist on the market. Try their monetary toolkit for victims of hurricanes Fiona and Ian.

What About State Help?

Go to FLGov.com for an inventory of how to obtain assist from the Florida Division of Emergency Administration (FDEM), akin to your nearest distribution level for emergency assist.

State officers have additionally issued three useful suggestions that apply to all victims:

- Name your insurance coverage supplier immediately and take tons of photographs of your property harm.

- See in case your county has arrange an “insurance coverage village” the place you possibly can file claims in particular person.

- Watch out for scams, and stick to assist supplied by .gov web sites and your individual insurance coverage supplier.

How Can I Help These in Want?

The workplace of Governor Ron DeSantis has formally endorsed the Florida Catastrophe Fund as a legit strategy to donate and assist victims.

Learn extra