Quicken has been considered one of my private favourite instruments to trace my funds since I graduated from faculty in 2009. They launched new software program every year, however you can proceed utilizing the older variations for those who didn’t need to improve.

You may nonetheless use among the older variations of Quicken in your laptop in the present day. You simply can’t robotically obtain transactions with out an annual subscription. As a substitute, you must manually enter transactions.

This generally is a painstaking course of. Since you must pay an annual subscription to proceed utilizing all of Quicken’s options, it’s possible you’ll need to contemplate your different choices.

Listed here are the professionals and cons of a number of different of my favourite cash administration options.

Empower

Empower is an organization that makes cash by managing folks’s investments. That mentioned, Empower additionally provides cash administration software program as a strategy to expose folks to their model and purchase new prospects over the long term. They provide a web-based answer, an iOS app, and an Android app.

Empower lets you hyperlink your monetary accounts to their software program. As soon as linked, transactions imported robotically. Then, Empower supplies loads of detailed studies that can assist you handle your funds based mostly on that info.

I take advantage of Empower to trace my web value as a result of it consolidates all of my accounts in a single place. I often use a few of their different options, however I don’t use it to trace my earnings or bills.

Options

Present private finance instruments Empower provides totally free embrace:

- Web value monitoring.

- Budgeting.

- Invoice-tracking.

- Money movement.

- Funding evaluation.

- Retirement planner.

- Financial savings planner.

- Price analyzer.

As soon as your web value reaches a sure stage, Empower monetary advisors will attain out to you to supply their fee-based providers.

I personally don’t use their fee-based funding administration, however you’ll have to resolve whether it is value it for your self. You may nonetheless use the free software program no matter whether or not you utilize their fee-based funding administration providers.

Empower execs

- Free to make use of.

- Tracks greater than solely web value.

- Automated syncs with many accounts.

Empower cons

- After you attain a certain quantity of belongings, anticipate calls attempting to promote their funding providers.

- Accounts can have bother syncing.

- Free instruments are an addition to the principle Empower providing so will not be as in-depth as budgeting targeted options.

(Private Capital is now Empower)

Study extra about Empower or learn MU30’s full evaluation.

You Want a Funds (YNAB)

You Want a Funds, generally referred to as YNAB for brief, is a budgeting device constructed from a person’s home made budgeting instruments. The software program has grown by leaps and bounds since then and now focuses on giving budgeters the instruments they should funds and succeed.

The software program relies round a 4 rule budgeting system. When you perceive the foundations, the software program helps you comply with them to funds whereas attempting to keep away from frequent failures. The foundations are:

- Give each greenback a job.

- Embrace your true bills.

- Roll with the punches.

- Age your cash.

Options

The software program comes with loads of options, too. They embrace:

- Entry to your data from any system.

- Budgeting instruments.

- Purpose monitoring.

- Spending, web value in addition to earnings and expense studies.

You may subscribe to YNAB for $11.99 per 30 days or lower your expenses by paying $84 yearly. You need to use YNAB virtually anyplace you’re. They’ve a web-based possibility, iOS app, Android app and even apps for iPad, Apple Watch and Alexa.

I just like the idea of YNAB and imagine this software program could be tremendous helpful in serving to somebody funds efficiently in the event that they have been simply getting began budgeting. Nevertheless, I’m at a unique stage in my monetary life and like to stay with what I’ve used up till this level.

YNAB execs

- 34-day free trial.

- Budgeting based mostly on a philosophy that can assist you achieve success.

- Free programs and video workshops.

- Hyperlink accounts to the YNAB app.

- Many apps to trace your cash anyplace, together with Alexa.

YNAB cons

- Month-to-month or annual subscription fee required after free trial.

- Budgeting targeted on YNAB’s methodology which can not work for everybody.

Study extra about YNAB.

Unifimoney

*Editorial Word: This supply is not out there. Please go to the Unifimoney web site for present phrases.

Primarily based in San Francisco, Unifimoney makes a speciality of automating the numerous time-consuming duties related to cash administration.

Unifimoney is ideal for many who need to get began with investing however don’t actually have the additional bandwidth to study a brand new platform. With Unifimoney, you get a high-yield checking account, in addition to a financial savings account and a bank card that turn out to be your all-in-one digital cash administration app. The app is at present solely out there to iOS customers, however Unifimoney hopes so as to add Android and Desktop entry sooner or later.

Options

When you’ve made your $100 minimal deposit and arrange your account, you’ll get entry to the next options:

- Checking stability earns 0.20% APY.

- Invoice pay, direct deposit, distant verify deposit, and a debit card.

- Price-free ATM entry.

- Curiosity could be directed to your portfolio.

- Fee-free investing.

- Cryptocurrency and treasured metallic investing.

If, like me, you’ve been eager about investing in cryptocurrencies, Unifimoney can actually come in useful. With greater than 30 completely different cryptocurrencies supported, you’ll be able to construct a portfolio that features cryptocurrencies and treasured metals alongside shares and ETFs. You may have your curiosity robotically moved to your portfolio, in addition to a minimal month-to-month quantity beginning at $25.

The Unifimoney checking account packs loads of options, together with invoice pay, distant verify deposit, and even a checkbook in case you ever want it. It’s also possible to join a bank card (Unifi Premier) that can roll out in Q3 incomes 2% money again, with the choice of placing that money into your investments.

Unifimoney execs

- Excessive-yield checking with 0.2% APY.

- Full-featured checking, together with invoice pay and direct deposit.

- Automated investing in cryptocurrencies and different belongings.

- Self-guided, commission-free investing.

- Unifi Premier bank card earns you money again of two%.

Unifimoney cons

- Minimal stability or month-to-month deposits required for fee-free checking.

- No money advance function.

- $100 minimal opening stability.

Study extra about Unifimoney.

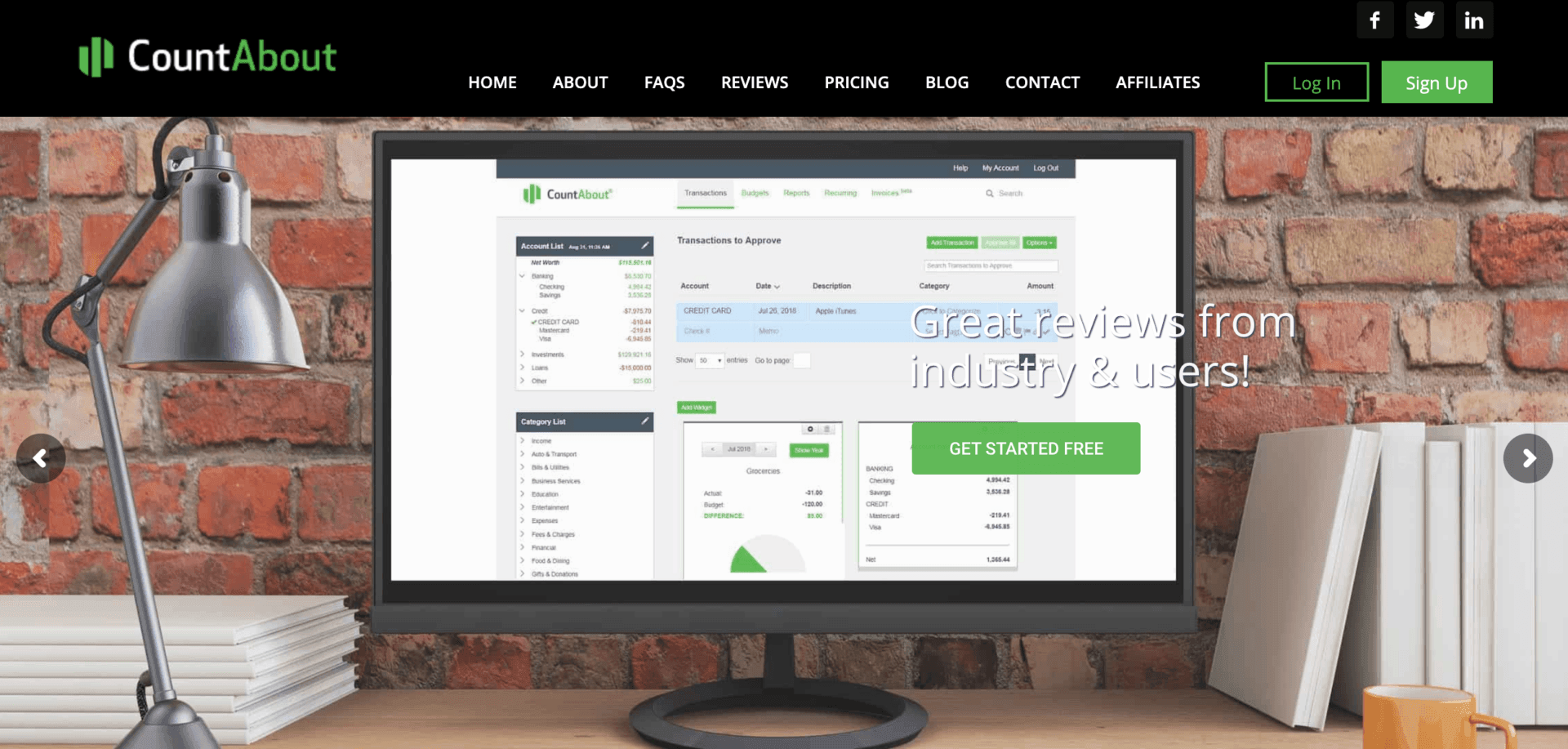

CountAbout

CountAbout is a web-based private finance app that lets you import your historic information from Quicken or Mint. When you’re switching software program, it’s at all times good to carry your historical past with you. You may both use their web-based app, iOS, or Android apps. It additionally provides a free 15-day trial.

Options

CountAbout provides many options that may enable you handle your funds. Particularly, they provide the next options:

- Budgeting.

- Customizable classes and tags.

- Recurring transactions.

- Automated transaction downloads (with a Premium subscription).

- Attaching receipts to transactions ($10/yr extra charge).

- Monetary studies.

- Invoicing capabilities ($60/yr extra charge).

- FIRE widget.

- No commercials.

Pricing begins at $9.99 per yr for a Fundamental subscription. This permits guide enter of transactions or file imports from QIF information. When you’d fairly have your transactions robotically downloaded, it’s included within the Premium subscription which prices $39.99 per yr.

CountAbout additionally provides add-ons. If you have to connect photographs, that will increase the worth by $10 per yr. Including invoicing capabilities will increase the worth by $60 per yr. I like the truth that I might import my Quicken information if I made a decision to modify, however the annual charge and the barrier of studying new software program have stored me from switching to CountAbout.

CountAbout execs

- Free 15-day trial.

- Can import historical past from Quicken.

- Can robotically obtain transactions with a Premium subscription.

- Invoicing capabilities for small companies with a charge.

- Potential to trace your FIRE timeline.

- Net-based or telephone apps out there.

CountAbout cons

- Requires an annual subscription for even probably the most primary possibility.

- Add-on charges can add up for those who want invoicing or picture attachment choices.

Study extra about CountAbout or learn MU30’s full evaluation.

Pocketsmith

Pocketsmith is a strong monetary administration device you should use to get an outline of your funds. It has a web-based answer in addition to an iOS and Android app you should use.

Options

PocketSmith provides a number of options together with:

- Dashboard overview.

- Web value statements.

- Revenue and expense studies.

- Money movement studies.

- Automated financial institution feed importing.

- Categorization and labeling based mostly by yourself classes.

- Budgeting with the pliability to satisfy your wants together with each day, weekly, month-to-month and extra choices.

- Helps a number of currencies in spending accounts, belongings and liabilities.

- Forecasting instruments.

- A funds calendar that can assist you visualize your payments and their due dates.

- What-if situations to check your forecasting in opposition to a number of choices.

Whereas most apps deal with U.S.-based shoppers, this app lets you mix accounts throughout many international locations and currencies. This may help international residents get a single view of their international funds.

This isn’t an enormous deal for me as all of my funds are based mostly in U.S. {Dollars}, however I might see it serving to others with extra sophisticated funds handle their cash simpler.

Pocketsmith execs

- Automated financial institution feeds from over 12,000 establishments.

- Many studies and forecasting instruments.

- Handle currencies, belongings, and liabilities from a number of international locations in a single place.

- Affords a reduction for an annual subscription.

- Safe two-factor authentication.

Pocketsmith cons

- Month-to-month subscription charge or annual charge with a reduction.

- Premium and Tremendous subscriptions are comparatively costly in comparison with different choices.

Study extra about Pocketsmith or learn MU30’s Pocketsmith evaluation.

Evaluating all of the options

| Empower | CountAbout | Pocketsmith | YNAB | Unifimoney | |

|---|---|---|---|---|---|

| Value | Free primary service, with an additional value for monetary administration | Begins at $9.99/yr | Free-$19.95/month | $11.99/month or $84/yr | Free so long as you meet minimal stability necessities, that are $20,000 in your account or $2,000 in direct deposits every month |

| Fundamental options | • Web value monitoring • Budgeting • Invoice-tracking • Funding evaluation • Price analyzer |

• Budgeting • Automated transaction downloads • Monetary studies • Attaching receipts to transactions • FIRE widget |

• Web value overview • Revenue and expense studies • Budgeting • Forecasting instruments |

• Budgeting • Purpose monitoring • Web value, spending, earnings studies |

• Excessive-yield checking • Automated investing • Cryptocurrency investing • Free ATM withdrawals |

What’s Quicken?

Quicken is a cash administration software program that may enable you handle your private funds, investments, rental properties, and enterprise.

You may full the next duties with Quicken relying on the extent of software program you buy:

- Handle spending.

- Budgeting.

- View and pay payments.

- Monitor investments.

- Plan to your retirement.

- Handle a enterprise.

- Handle rental properties.

The software program is out there for Home windows or Mac computer systems however the house and enterprise model isn’t out there on Macs. Quicken additionally has a cell companion app that’s out there for iOS and Android gadgets.

You should purchase a subscription based mostly in your wants beginning at $34.99 and going as much as $89.99 for one yr. A two-year subscription possibility runs from $69.98 to $159.98 relying on the software program you want.

Monitoring your funds is best than avoiding a call

It’s extra essential to trace your funds than selecting the right software program to take action. Monitoring your funds provides you a transparent image of the place your cash goes. It additionally provides you alternatives to search out areas the place you’ll be able to enhance.

I do know once I began monitoring my funds, I grew to become way more aware of each expenditure I made. Did I actually need it? Or was there a greater use for the cash?

Decide a monitoring software program from the above record and begin monitoring your funds in the present day. When you discover out it doesn’t work, you’ll be able to at all times change later when you get an concept of the options you want or need.

Abstract

Selecting an alternative choice to Quicken will rely in your particular funds and your wants. Whereas all the above software program options can observe your funds, you’ll want to determine which one works greatest for you.

It might take some trial and error, however discovering the right software program answer to trace your funds could make the duty a lot simpler and help you begin enhancing your funds rapidly.

Learn extra:

Empower Private Wealth, LLC (“EPW”) compensates Webpals Programs S. C LTD for brand new leads. Webpals Programs S. C LTD just isn’t an funding consumer of Private Capital Advisors Company or Empower Advisory Group, LLC.