Let’s get official: in response to the Nationwide Bureau of Financial Analysis, a recession is a big decline in financial exercise unfold throughout the economic system, lasting quite a lot of months, usually seen in actual GDP, actual earnings, employment, industrial manufacturing, and wholesale-retail gross sales.

One other widespread definition of a recession is when the economic system shrinks for 2 straight quarters. This “shrinking” comes within the type of damaging GDP (or Gross Home Product) progress.

Irrespective of the way you slice it, a recession is a damaging financial prevalence that usually ends in monetary ache for many people.

What’s the Distinction Between a Recession and a Despair?

Like getting a chilly, recessions could be gentle, extreme, or something in between. Whereas recessions aren’t a superb factor, they don’t all the time should be catastrophic for the economic system. Actually, many specialists are projecting that if the U.S does enter a recession quickly (if not already), it will likely be milder than the earlier giant recessions the nation has confronted.

Not like a recession, there’s no commonplace financial definition for a melancholy. The one actual body of reference we have now for a melancholy is the Nice Despair that adopted the inventory market crash of 1929. That interval was marked by deep and sustained job losses, poverty, and hopelessness. It lasted about 10 years versus the 2008 monetary disaster recession that lasted 18 months.

What Causes a Recession?

Supply: makeameme.org

Our economic system is made up of individuals, companies, and governments spending cash. Each time considered one of these teams spends on one thing, that cash goes into the pocket of another person. This round motion of cash and the way a lot cash is on the market to be spent is the underpinning of how the economic system works.

Within the U.S, about 70% of financial exercise is pushed by one thing referred to as “client spending,” which is how a lot folks spend on items and companies.

This willingness to spend, and the provision of cash, modifications over time on account of many macro components, creating the enterprise cycle.

Client Negativity and Psychology

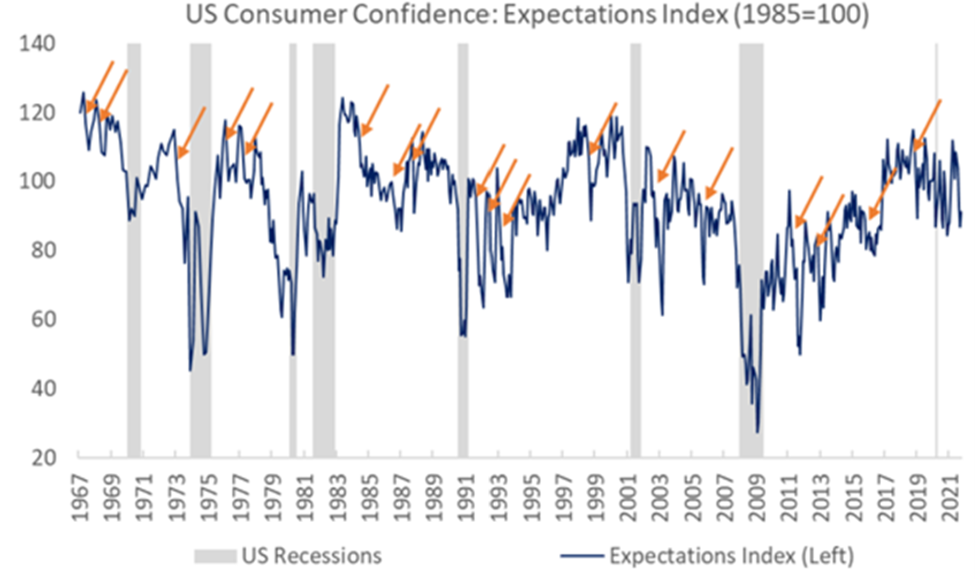

Not surprisingly, the higher you’re feeling about your future monetary prospects, the extra probably you’re to spend cash on these sneakers or new iPhone within the subsequent 12 months. That’s client sentiment or confidence. It’s a number one financial indicator that may predict how keen shoppers are to spend — and because of this, predict an upcoming recession.

However since there are such a lot of issues that may impression our collective willingness to spend (and our emotions concerning the future), dips in client confidence/sentiment don’t all the time lead to recessions.

Supply: The Convention Board

Rising Curiosity Charges

Rates of interest are a key driver of normal monetary circumstances.

When occasions get powerful, monetary establishments are inclined to decrease issues like rates of interest and lending requirements, to spice up the provision of cash (credit score) and shoppers’ and enterprise’ means to spend it. Armed with extra money and cheaper charges, shoppers are incentivized to spend on items and companies, whereas companies spend on hiring or different investments. That is the setting that was created in 2020 by the Federal Reserve and U.S authorities.

However when the economic system will get going once more and begins operating too scorching, those self same establishments improve rates of interest and tighten lending requirements, getting cash dearer and fewer out there. This discount of cash availability and better prices for current debt reduces shoppers’ and companies’ means to spend.

As spending slows, so does the economic system. A standard motive for elevating rates of interest is when the energy of the economic system creates an excessive amount of inflation. That is precisely what’s taking place proper now because the world struggles with excessive inflation popping out of the pandemic.

On their very own, rising rates of interest don’t all the time lead to recessions, however they do have a serious impression on shoppers, traders, and the economic system.

Learn Extra: Understanding the Yield Curve: The Most Essential Market Indicator You’ve By no means Heard Of

Asset Bubble Blow-Ups

Asset bubbles occur when market costs for various kinds of investments rise to the purpose the place they commerce effectively above what they’re value.

These bubbles are inclined to happen on account of a mixture of investor psychology, low rates of interest, and non permanent imbalances in provide and demand.

Learn extra: Financial Bubbles: What They Are, Why They Occur, and Why You Ought to Care

There are a lot of well-documented situations in financial historical past the place the popping of an asset bubble is adopted by a recession. The 2008 collapse of the housing market, and the monetary property tied to it, pushed the U.S into one of many deepest recessions on report.

The popping of an asset bubble is pushed by many components and once they occur, entry to credit score and client/investor optimism are inclined to dry up, resulting in reductions in client and enterprise spending, in addition to job losses.

All these components mixed result in a recession.

Supply: imgur.com

Deflation

Whereas inflation can result in a recession, so can deflation. Deflation occurs when costs for items and companies decline, inflicting shoppers to delay purchases in anticipation of costs declining additional. This ends in damaging inflation.

Supply: Giphy.com

Deflation causes a suggestions loop the place each shoppers and companies cease spending, leading to job losses, contractions in wages, and the slowing of the economic system. A weak economic system can heighten the fears of deflation which, in flip, drives an additional downward financial spiral.

To beat deflation, central banks reduce rates of interest to incentivize spending and governments undertake insurance policies to extend discretionary spending capability.

Many nations have skilled deflation through the years, however the trendy poster little one of deflation has been Japan’s struggles with it because the mid-Nineteen Nineties.

How you can Put together for a Recession

Regardless of the actual fact it’s unattainable to foretell once we’ll fall right into a recession, there are a number of issues you are able to do to organize.

Get Educated and Don’t Panic

The extra you already know about what recessions are, how they work, and the way lengthy they final, the higher psychologically geared up you’ll be to cope with them. Though they’re scary, remember that relationship again to 1945, the common recession lasted 11 months and resulted in a 2.4% drop in GDP.

These common figures are far much less extreme than the 5.10% GDP contraction that occurred throughout 2008 monetary disaster and the 19.2% contraction that occurred in the course of the peak of the 2020 pandemic.

Actually, most recessions which have occurred since 1945 resulted in a 0.30% to three.70% contraction. Subsequently, at any time when the recession discuss begins, don’t panic. Since there’s solely a lot you possibly can management, the most effective factor to do first is give attention to what you possibly can management and remind your self that this too shall go.

Supply: Ben Carlson, A Wealth of Widespread Sense

Save Extra

Since recessions sometimes include job losses, it might be a good suggestion to start out constructing extra padding in your emergency fund in case your job is in danger.

When the economic system falls, jobs associated to gross sales, advertising and marketing, product administration, and recruitment could be hit the toughest, particularly if they’re associated to an organization’s non-core enterprise.

Standard knowledge tends to counsel that you just construct an emergency fund of three to 6 months, relying on the kind of job you’ve got. However growing that quantity to eight to 11 months could offer you extra of a monetary cushion and better piece of thoughts.

Use our Emergency Fund Calculator to find out how a lot you need to have in yours.

Begin a Facet Hustle

Probably the most unlucky factor a couple of 9-5 is that your predominant supply of earnings is reliant on one group. In a downturn, that earnings can evaporate, leaving you out to dry.

With a lot job instability lately, beginning a aspect hustle could be top-of-the-line issues you are able to do to scale back your reliance in your 9-5 employer. Consider it like an insurance coverage coverage.

There are a lot of methods you can begin a aspect hustle; you simply must assume creatively and get began.

Learn extra: Facet Hustle Concepts: 35+ Methods Anybody Can Earn Extra Cash on the Facet

Scale back Debt

Having an excessive amount of debt going right into a recession could be the quickest approach to put your self in actual monetary hassle. When occasions get powerful, debt can both present you a lifeline to bridge non permanent shortfalls or can kill you in case you should make funds on high-interest obligations.

The easiest way to mitigate these dangers is to maintain your excellent debt low throughout good occasions, make paying off debt a precedence when you’ve got additional money, and keep away from bank card debt.

Learn extra: How you can Pay Off Credit score Card Debt Quick

The Backside Line

Regardless of how scary recessions are, keep in mind that whereas they’re inevitable, they don’t final without end and aren’t all the time deep or lengthy. As a person, there’s solely a lot you are able to do main as much as one and through one, so give attention to the issues you possibly can management.

The perfect factor to do is all the time be looking out for the indicators of a recession and be sure you put your self in the most effective place to get by means of it — earlier than they occur. Sadly, recessions are a characteristic, not a bug of how the economic system works.

Featured picture: gguy/Shutterstock.com

Learn extra: