How you can use YNAB

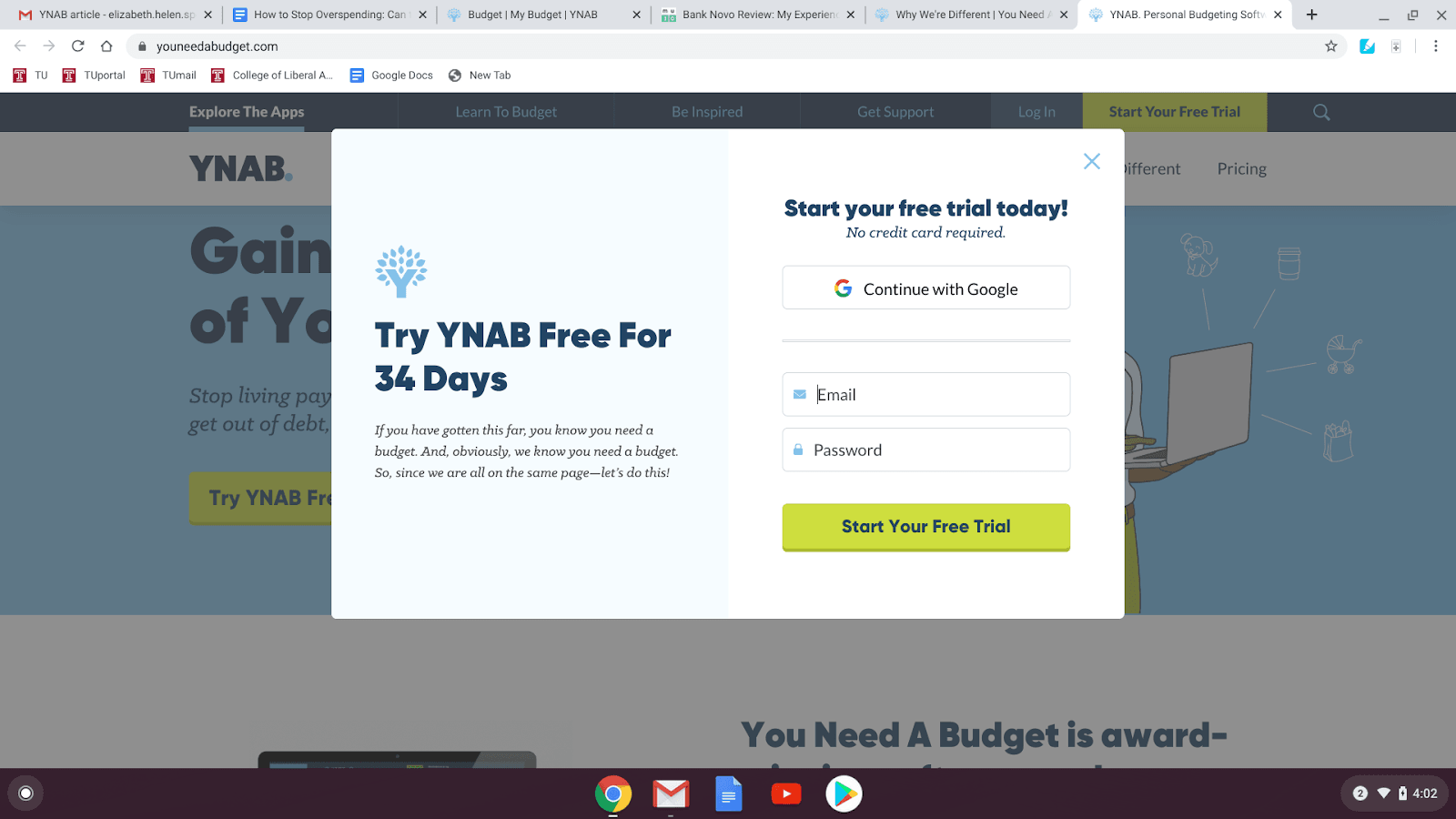

Your YNAB journey begins with a free 34-day trial. I appreciated the truth that they didn’t ask for a bank card at sign-up.

As soon as you place in your e-mail and create a password, you need to comply with the Phrases of Service.

Then you definitely’ll reply some questions on your circumstances and causes for making an attempt YNAB. And that’s it. You’re all set and able to begin budgeting. Fast and simple.

Step one is so as to add a checking account, which will be linked or unlinked. Personally, I linked mine for simple transaction importing, however since YNAB’s method is all about being proactive, you possibly can manually add a beginning stability and every transaction. That is additionally good for anybody who feels uncomfortable sharing their checking account login info despite YNAB’s safety measures.

You may add a wide range of accounts, for each budgeting and monitoring. To be trustworthy, I haven’t discovered the monitoring characteristic to be that helpful (I favor Mint’s dashboard for watching my retirement account develop). To maintain it easy, simply begin with a checking account. You’ll give it a nickname and enter a beginning stability.

You’ll see default finances classes, however you possibly can delete something that doesn’t apply to you and add classes as wanted. For instance, I created a “homemaking” class for getting photos framed, shopping for vacation decorations, and different bills associated to preserving household reminiscences and making our home really feel like a house.

How a lot does YNAB price?

After your 34-day free trial, you’ll need to pay for YNAB if you wish to maintain utilizing it. Select between a month-to-month or annual subscription:

YNAB options

There are many free budgeting apps on the market. Right here’s what units YNAB aside and, in my view, makes it value paying for.

Working stability

Whether or not you hyperlink your checking account to YNAB or add transactions manually, you don’t simply see your present out there stability (as proven in your on-line or cell banking app). As an alternative, YNAB takes your cleared (out there) stability and subtracts any transactions you’ve logged (reminiscent of a test you wrote) that haven’t hit your checking account but.

Cleared stability – uncleared stability = working stability

That is how a lot cash you really have. Use your working stability to make spending selections and also you’ll keep away from overspending your account earlier than a test or recurring cost is processed.

To Be Budgeted

One in all YNAB’s fundamental guidelines is to “give each greenback a job.”

The “To Be Budgeted” field on the prime of your finances show exhibits you the way a lot cash has come into your account that hasn’t been assigned a job in your finances but. The purpose is to all the time have TBB at $0.00. This implies each cent has been allotted to your common bills and priorities. It doesn’t imply that each greenback has been spent.

For instance, let’s say you add $100 every to your auto upkeep and trip classes. That cash will stay in your checking account however you gained’t spend it since you’re budgeting with YNAB, not making spending selections based mostly in your out there stability.

Setting cash apart for each the inevitable (a automobile restore) in addition to the specified (per week on the seaside) will maintain you from frittering your additional money away on takeout dinners and different impulse spending that doesn’t replicate your true priorities.

Age of Cash

The Age of Cash characteristic exhibits you the way lengthy you’ve had your money with out spending it. In case your cash ages past 30 days, you’ve formally graduated from dwelling paycheck to paycheck.

That is one in all my favourite options, because it helped me grasp the significance of not spending each cent and constructing a cushion as a substitute, not simply in financial savings and retirement accounts, but in addition in my checking account.

Targets

You may set a month-to-month purpose for every of your spending classes. For instance, if you wish to save $1,000 for a trip in 10 months, you’d set a month-to-month purpose of $100 to maintain your self on monitor.

What I discovered notably useful is the “Payoff Stability by Date” perform of targets for bank card accounts. It’s one factor to assume, “I’d wish to be debt-free by X date,” however is it really possible?

With YNAB, you place your stability payoff date into their calculator, which then tells you the way a lot you’d must pay every month.

You may then determine if that’s cheap, or if you happen to ought to make extra cash on the facet to fulfill your purpose. If not, you possibly can select a payoff date purpose that matches your finances.

Pockets

To make sure your finances displays each final cent you herald and spend, you possibly can add a money account known as “Pockets” to your ledger. Merely manually enter any money you earn or are gifted, in addition to what you spend it on.

This could possibly be particularly useful for folks working in hospitality, eating places, and different professions through which money ideas or wages are paid.

Experiences

This characteristic gives a big-picture view of your spending habits and funds. You may see how a lot you spent in every class over a sure time frame.

Relying on what number of accounts you hyperlink for monitoring, you possibly can see your complete internet value of belongings minus debt.

My YNAB expertise

One facet perk of being a private finance author is studying about each new budgeting system, high-interest financial savings account, spare change funding app, and so forth. As soon as I’d learn enthusiastic evaluations of YNAB in just a few completely different locations, I made a decision to strive it for myself.

Listed here are the 5 most essential classes I’ve realized:

1. Checking account stability ≠ spending cash

I used to easily test how a lot cash was in our joint account once I needed to know if I might afford to signal the children up for a brand new exercise or pay somebody to color our bed room.

If there was sufficient money in there, I’d spend it. A number of days or per week later, my husband would ask why I’d spent cash on x when y invoice was scheduled to return out later within the month.

2. Give each greenback a job

The YNAB system really seems to be quite a bit like my father-in-law’s handwritten ledger. He has classes for “subsequent automobile,” “residence repairs,” and many others. His precise checking account stability has nothing to do with how a lot he spends on a dinner out after we go to — that’s dictated by the “Enjoyable Cash” class in his ledger.

YNAB primarily digitizes this, serving to me see that I shouldn’t spend on residence enchancment till I’ve saved sufficient in that class.

Learn extra: When it’s OK to spend cash

3. All bank card expenses needs to be budgeted

One in all my favourite issues about YNAB is the way it holds you accountable for bank card spending. For those who at present carry a stability, you possibly can arrange a payoff purpose and YNAB will provide help to keep on monitor for the mandatory month-to-month funds.

It additionally consists of your entire card expenses within the “transactions to be categorized” ledger. That cured me of the delusion that bank card spending was someway separate from my household’s common finances.

Learn extra: How you can use a bank card responsibly

4. Spend approach under your means

By reminding me to set cash apart for automobile repairs, medical payments, and the opposite “sudden” bills which can be actually simply inevitable over the course of a 12 months, YNAB has helped me see how far under my internet revenue I ought to actually be spending.

A separate emergency fund is ok, however I now see how a lot of a money cushion I ought to have in my checking account. Completed accurately, YNAB eliminates the necessity for a separate emergency fund or different kind of financial savings account, until you need one.

Learn extra: Emergency funds: all the things it’s essential know

5. Change doesn’t occur in a single day

After I was younger and making quite a bit much less cash, I lower my spending naturally. My pals had been largely of the liberal arts selection, too; we didn’t have cash to blow on consuming in bars or consuming at costly eating places. So, we cooked collectively and shared massive bottles of low cost wine in one another’s flats.

Someplace alongside the best way that modified. It’s like all of us progressed by “life-style creep” on the similar tempo. Now, my greatest bills are associated to my children, just like the aforementioned preschool/childcare prices. There’s solely a lot I can do about that with out quitting my job or placing my children in an unlicensed facility.

Nevertheless, I’m embracing the “change occurs slowly” mantra. After quickly giving up on YNAB earlier than I returned to it to jot down this text, I’m making a each day behavior of checking my finances and categorizing my spending. I see the change in my attitudes towards cash and on a regular basis spending habits. Finally, that can translate to extra dramatic modifications in my funds as I repay debt and amass that money cushion.

Who ought to use YNAB?

Persistent overspenders

For many people (myself included), ‘psychological budgeting’ isn’t a robust or concrete sufficient framework to discourage overspending. Utilizing YNAB will make you extra conscious of how a lot cash you even have, the place it’s going, and what it’s essential change to cease working out of cash earlier than the subsequent paycheck.

{Couples}

For those who’re making an attempt to finances collectively (versus letting one particular person handle the cash), YNAB may give you a impartial image of your finances and cash. This will provide help to keep away from arguments and different sturdy feelings many people have about spending. It may additionally empower you to make decisions collectively and rejoice as a staff once you attain a particular purpose.

Debtors

As talked about earlier, the Targets characteristic is a useful gizmo for determining how a lot it’s essential pay month-to-month to repay a stability by a sure date. This replaces the hazy sense of “sometime” I’ll be debt-free with “I’ll repay my pupil mortgage by January 2025.”

These with finance-induced stress

Budgeting can profit each your monetary and psychological well-being by restoring your sense of management and company.

For those who really feel restricted by the information your checking and financial savings accounts present, and/or if you happen to don’t have the endurance for budgeting manually, paying for an in-depth, automated budgeting answer may be cash properly spent. $100 a 12 months is value a major discount in stress.

Who shouldn’t use YNAB?

In my present stage of life, with a partner to co-budget with and two kids to assist, YNAB helped me get a deal with on my sophisticated funds.

However the much less cash you’ve, the extra conscious you’re of each cent you’ve, as a result of there’s no room to mess up. And whereas I feel everybody might get one thing out of YNAB, it will not be obligatory (or reasonably priced) for somebody actually dwelling on a shoestring finances.

For those who’re making an attempt out budgeting apps for the primary time and your monetary scenario is comparatively easy (e.g., you’re single with no kids), experiment with a easy, free budgeting app first earlier than you allocate cash to an all-encompassing app like YNAB.

YNAB alternate options

YNAB isn’t the one budgeting software program/app. Listed here are a pair alternate options if $14.99/month or $99/12 months is above your value vary.

PocketSmith

- Value: Free for fundamental options and paid plans begin at $9.95 per 30 days ($7.50 per 30 days when paid yearly)

- Hyperlink to financial institution accounts? Sure

- Finest budgeting options: A customized dashboard the place you possibly can see all of your “monetary key metrics” like your internet value and spending exercise

PocketSmith helps you construct higher monetary habits by a timeline that features your previous and current behaviors. You may see how far you’ve come, in addition to the place your funds will seemingly be months and years into the longer term. This visualization might help maintain you motivated as you finances and save.

With PocketSmith, you possibly can connect with your monetary establishment to trace spending. The budget-setting characteristic helps you see the affect your spending can have in future years. PocketSmith is a superb app, however if you happen to aren’t taken with seeing your funds on a timeline, you could be higher off with YNAB.

MoneyPatrol

- Value: $59.99 per 12 months (after a 15-day free trial)

- Hyperlink to financial institution accounts? Sure

- Finest budgeting options: You may set a spending projection for every expense, and since your spending is monitored, the platform will know once you exceed that finances

Whereas MoneyPatrol packs within the traditional budgeting and monitoring options, what stands out most is its use of knowledge. This expertise gathers insights that provide help to learn to enhance your monetary standing.

Though budgeting and insights are a part of MoneyPatrol, the app is absolutely geared towards serving to you monitor your spending. Within the course of, you’ll be taught extra about your habits to be able to make changes as a way to attain your targets.

The underside line: Is YNAB value it?

Since there are many free budgeting apps and instruments on the market, you could marvel why it is best to pay for YNAB.

As is usually true with private finance, the reply is determined by your temperament and scenario. Some folks can follow a brand new finances or behavior with out exterior accountability. For me, the associated fee is value it as a result of:

- I feel YNAB presents a superior product to comparable free choices.

- Figuring out I’m paying for it encourages me to make use of it, identical to my fitness center membership.

Learn extra: